The Hedge Fund Risk Layer for Composer.

- Go-to-cash with ATR-based drawdowns

- Profit ratchet to lock in gains

Composer strategies are powerful, but they lack native circuit breakers. We simulated the 2022 crash to show the difference 100 lines of protective code makes.

BENCHMARK: TQQQ/UPRO CORE STRATEGY

Your capital stays in your brokerage. We use restricted API protocols to ensure funds can never be moved externally.

We never hold your assets. You maintain full ownership and control inside your existing Composer account.

You can kill our connection instantly from the Composer dashboard. You own the "Off" switch.

API secrets are encrypted and stored in isolated Hardware Security Modules, never in plain text.

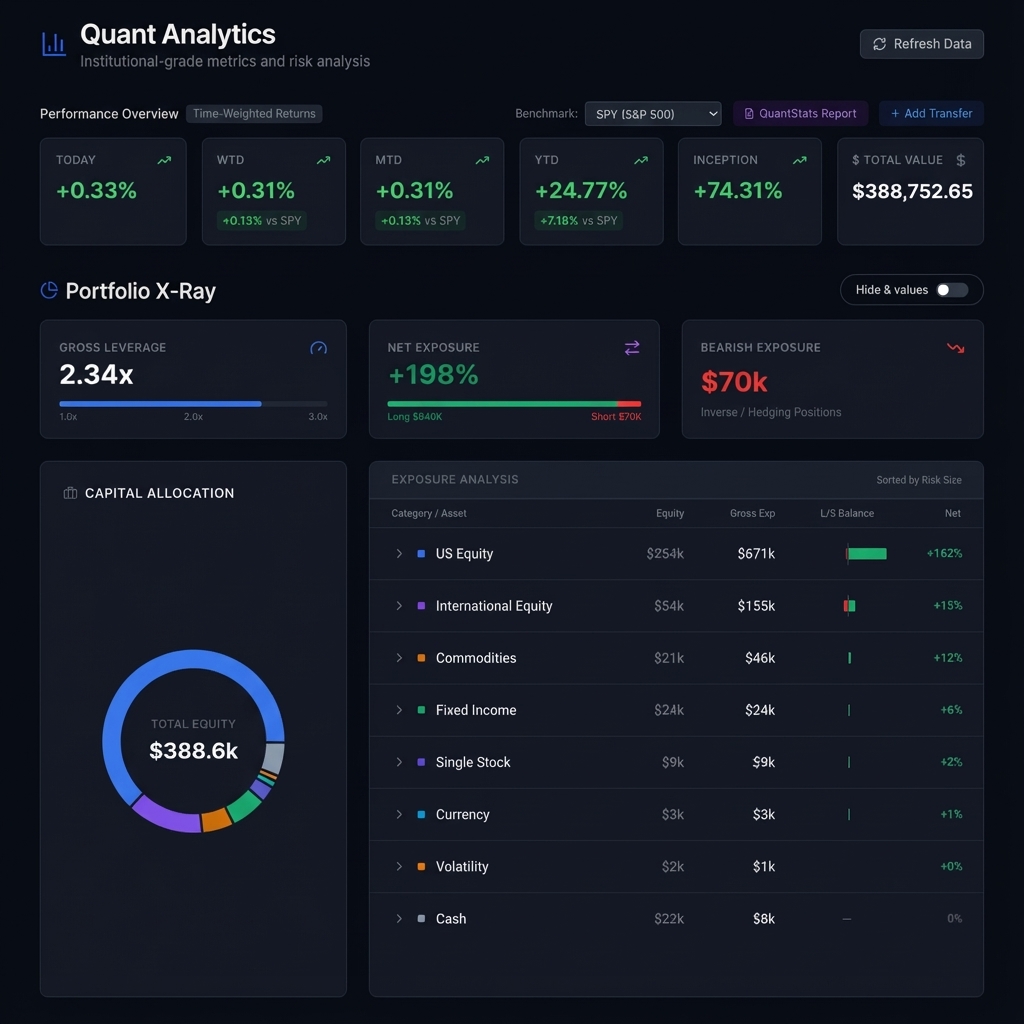

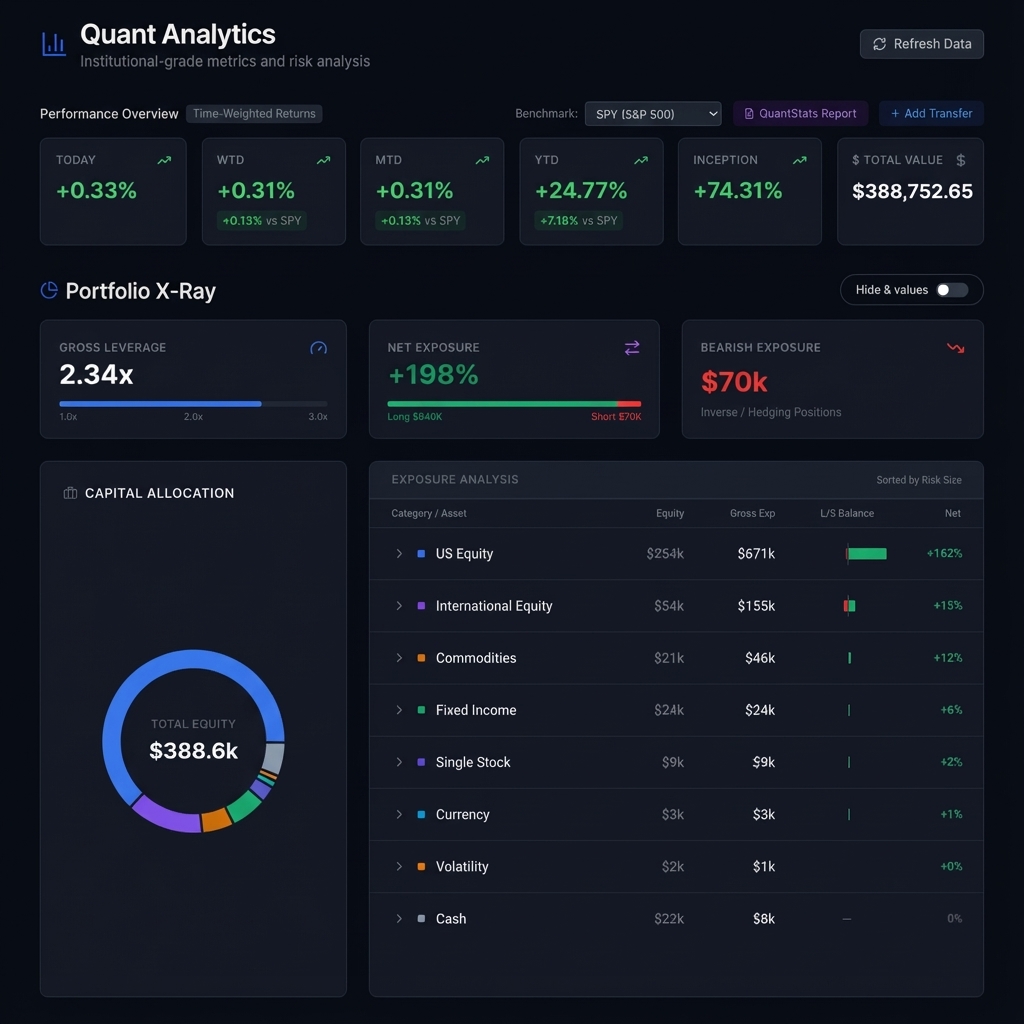

Six automated modules that turn a standard strategy into a resilient portfolio.

Automated liquidation when market volatility hits extreme thresholds.

Trailing profit stops that lock in gains while letting winners run.

Backtest your risk rules against 2008, 2020, and 2022 scenarios.

Live alerts when execution slippage deviates from backtest models.

Real-time analysis to ensure your strategies aren't just one big bet.

One-click emergency pause for all automated trading activity.

We're opening spots in batches. Founding members get direct access to the team and exclusive lifetime benefits.

Lock in the lowest price we'll ever offer, forever.

Request and vote on the next risk modules we build.

Connect directly with the developers and other quant builders.